Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

We are building the BlackRock of On-Chain Liquidity provision and risk adjusted portfolio management.

Massive TAM of $90B, Inevitable Adoption

"Today, there’s ~$90B in DeFi TVL. TradFi is entering. Retail is coming. Liquidity is the oxygen of this ecosystem — and we’re building the lungs."

We are currently live in Beta on Solana and as talking with multiple chain to bring our platform cross chain. Try it out: https://frnx.ai/chat

Backed by the Virtuals Ecosystem fund, Cambrian Labs and Confusion Capital the VC arm of Reserve Protocol.

Welcome to Franklin X, a cutting-edge platform designed to revolutionize how we approach cypto coin investments and portfolio optimization.

Harnessing the power of artificial intelligence, Franklin blends sophisticated analytics with seamless automation to deliver unparalleled insights and tools for navigating the volatile world of cryptocurrency.

Franklin X is built on the belief that community-driven strategies and advanced technology can unlock the true potential of decentralized finance (DeFi).

By leveraging AI to analyze trends, sentiments, and performance data, DeFi Vaults, we empower users to make informed investment decisions while optimizing risk and reward.

The vision extends beyond human users. We foresee AI agents also harnessing the power of decentralized token folios. For the average investor, the goal is simple: one-click access to entire market narratives—whether it's Real World Assets (RWA), DeFi, Memes, AI, DeSci, or GameFi—without getting lost in thousands of new token listings every day. Think of a DTF as an on-chain ETF that holds your ideal mix of crypto assets. To equip the crypto community with the best investment practices, we've included lessons from Modern Portfolio Theory (MPT)—targeting portfolios that optimize risk and return.

Imagine a world where you can put an AI agent to work 24/7 to optimize your crypto portfolio in the form of DTFs or maximize your DeFi yield while you sleep.

We are here to build just that.

Sentiment Analysis: Real-time scanning of social media platforms to identify trending tokens before they go mainstream.

Portfolio Optimization: AI-powered tools to automate buy/sell strategies and balance risk.

Performance Tracking: Detailed metrics on ROI, volatility, and trends to help users track and evaluate their portfolios.

Twitter Agent: A fully automated bot for engaging with the community and providing high-quality content.

Staking your tokens: Get a discount on 2,5% swap fees when staking your native token (token launching soon)

We are advancing autonomous liquidity provisioning in DeFi

Massive TAM of $90B, Inevitable Adoption

Today, there’s ~$90B in DeFi TVL. TradFi is entering. Retail is coming. Liquidity is the oxygen of this ecosystem and we’re building the lungs. We are currently live in Beta on Solana and as talking with multiple chain to bring our platform cross chain. Franklin X is more than just a trading tool; it’s a platform that combines cutting-edge technology with user-focused design to deliver a unique investment experience.

We’re Building the BlackRock of On-Chain Liquidity and risk adjusted portfolios.

1. Big Problem, Bigger Opportunity

DeFi protocols run on liquidity. Yet, liquidity provisioning is still a dark art complex, fragmented, and inefficient. Billions in capital sit idle or leak alpha due to poor strategies and bad UX.

2. Franklin X = Picks & Shovels for the Gold Rush

Franklin X is the bridge between passive capital and active, optimized yield opportunities. We make LPing and generating risk adjusted protfolios as simple as buying an ETF abstracting away risk, complexity, and volatility.

We're not just another DeFi tool. We’re infrastructure for capital efficiency.

3. AI + Automation = Unfair Advantage

Using AI-powered strategy generation and live risk profiling, our tool adapts in real time to market shifts. Think robo-advisor for DeFi liquidity and risk adjusted portfolios — with the intelligence of a quant desk and the simplicity of a mobile app.

proprietary strategy engine

superior UX

automation = scale

4. Monetization Is Obvious

We clip the ticket on optimized capital. Performance fees, protocol partnerships, and enterprise integrations. It’s the DeFi equivalent of Stripe — infrastructure with built-in demand.

5. Vision

Just like BlackRock owns the rails of TradFi, we’ll own the liquidity optimization layer of DeFi. Any capital entering on-chain markets through DAOs, funds, or retail apps, looking for yield will pass through our engine.

Getting access to Franklin X

Connect Your Wallet: Franklin AI supports a wide range of cryptocurrency wallets. Select your preferred wallet and follow the on-screen instructions to connect.

Start generating portfolios: Click on generate and swap a Portfolio to get started or roast your bags.

Visit : Navigate to our official landing page and click access "Access Franklin X"

Twitter Agent (coming soon):

Link your Twitter account to stay updated with automated high-quality posts and trending token analyses

Interact with the Agent and receive timely insights directly on Twitter

Free Access to Alpha:.

Receive recommendations based on the amount you want to invest and the length of your investment horizon. Franklin X will suggest a crypto portfolio tailored to your risk profile.

Swapping into these portfolios cost 2,5% swap fees, soon we will add staking support for our native token (launching soon) which will give you discount on swap fees.

AI-Driven Portfolio Management: Enable investors to efficiently manage meme coin portfolios using advanced AI predictions and strategies, with Stop loss and Take profit.

Swap Tokens: Seamlessly connect your wallet and swap into suggested AI portfolios.

Maximize Gains: Find the best liquidity pools to provide liquidity and earn yield. All risk parameters are fully automated, so you can sleep at night.

Discover Profitable LP Pools: In beta on Solana starting with Orca, Meteora and Raydium pools.

Automatic AI smart contract trading: Defi Vaults that trad LP pools and portfolios for you.

Franklin AI Agent offers robust tools and features to simplify and enhance your cryptocurrency investment journey.

Below, we outline the core functionalities that set Franklin AI apart as a meme coin portfolio optimization leader.

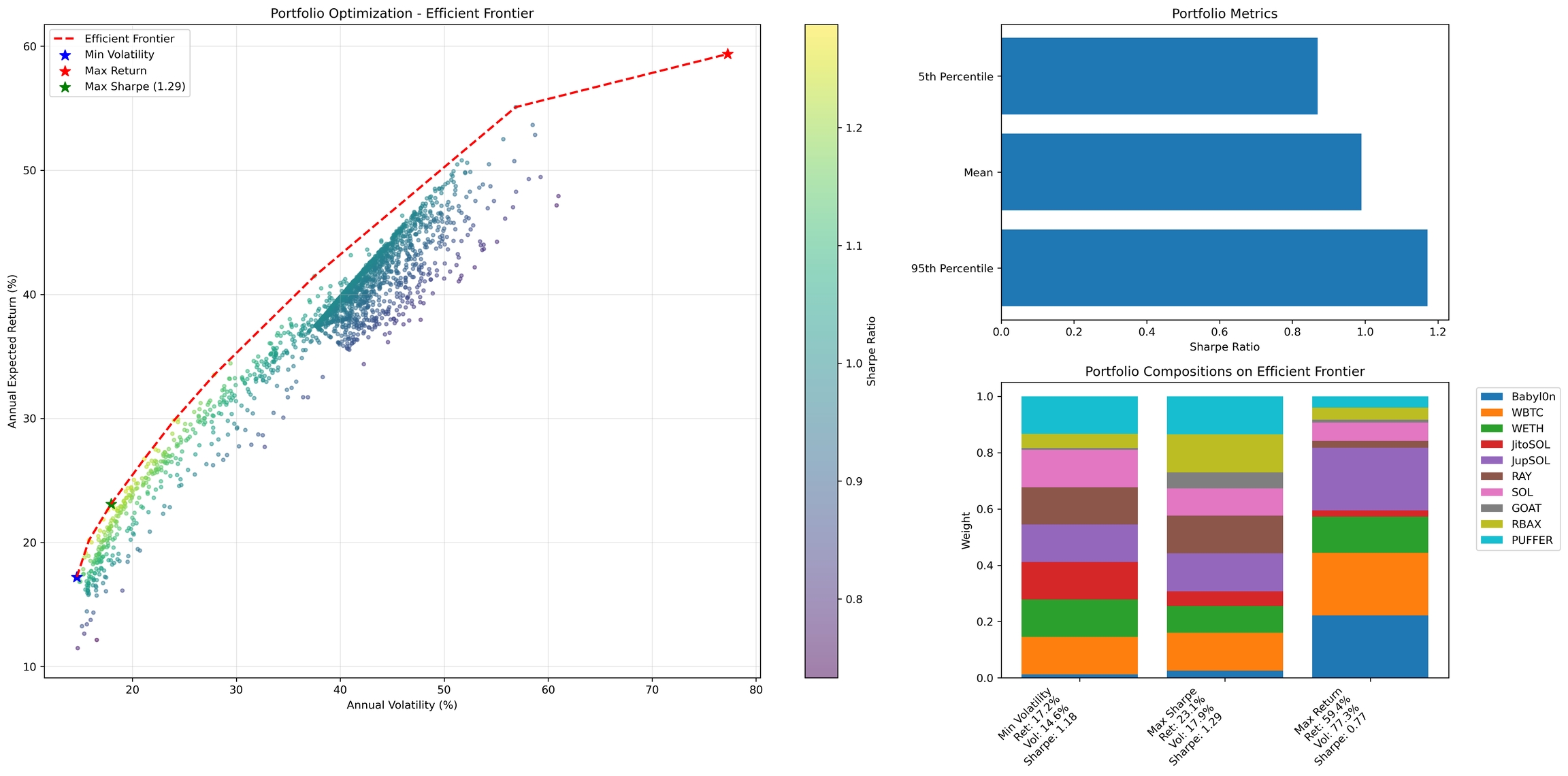

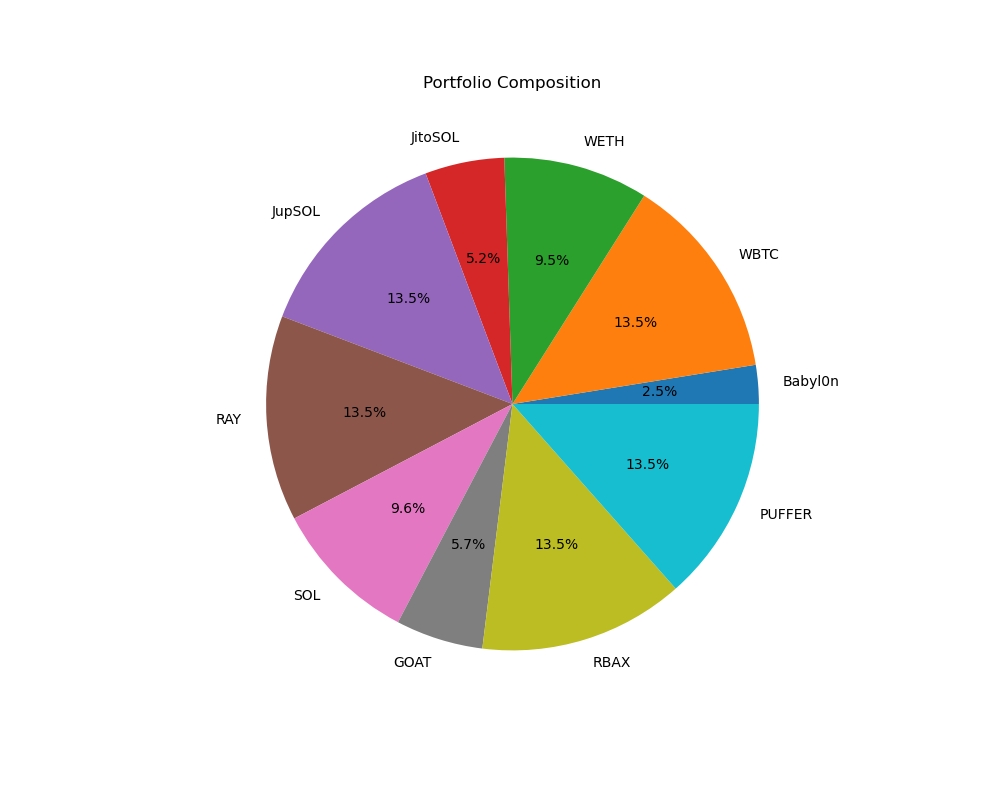

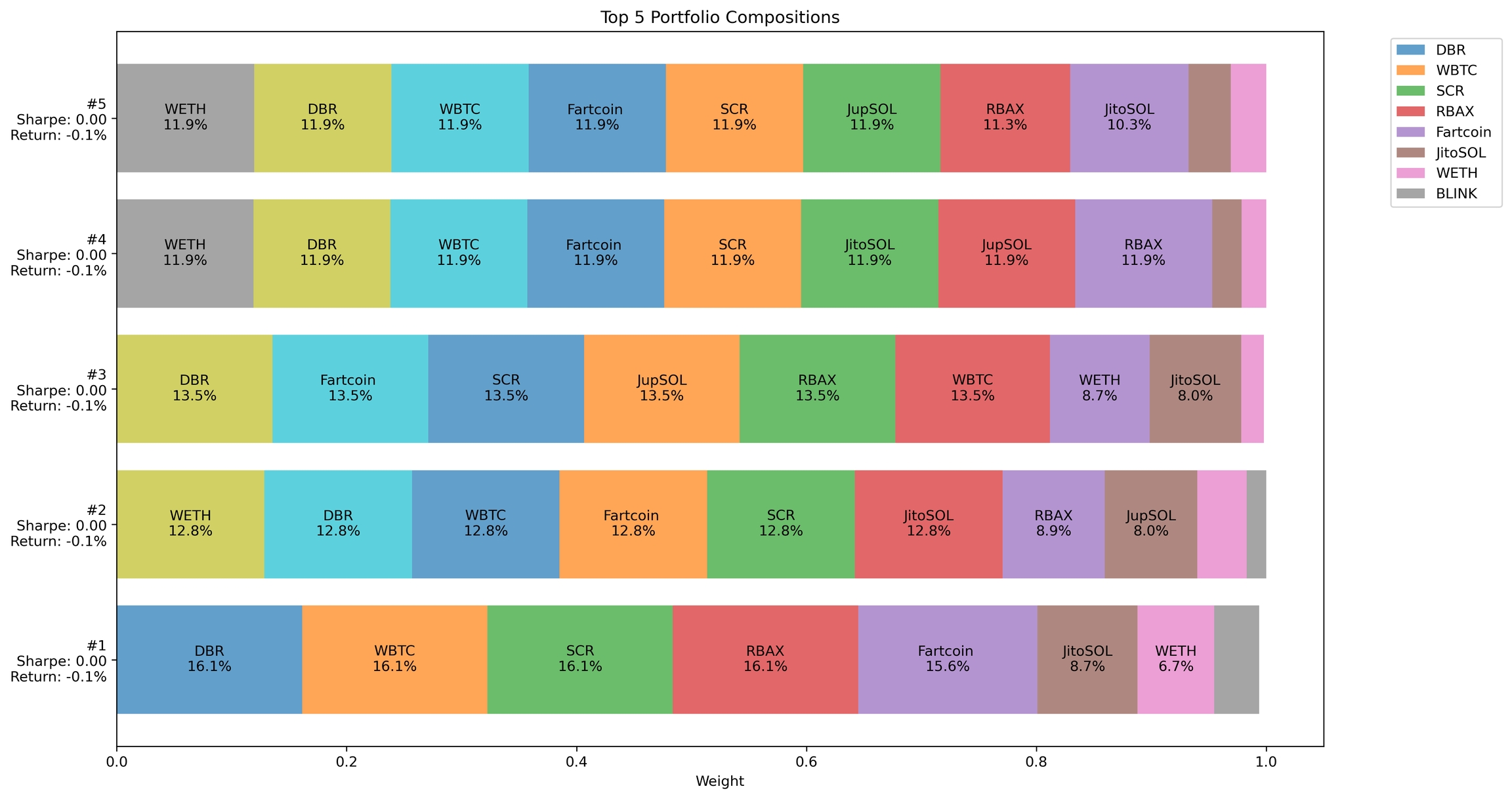

Leverage Franklin AI’s proprietary portfolio optimizer to create high-Sharpe portfolios tailored to your investment goals.

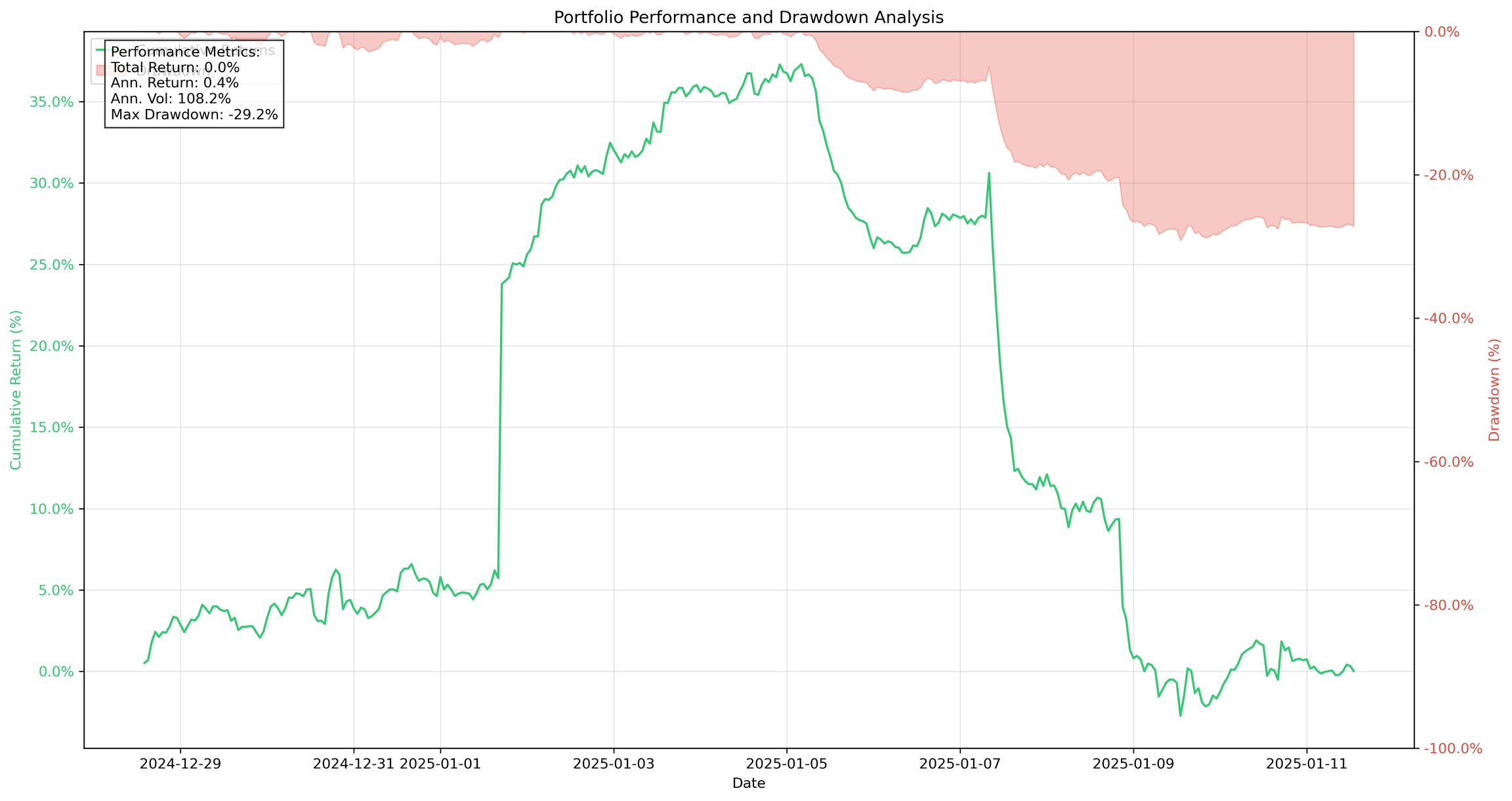

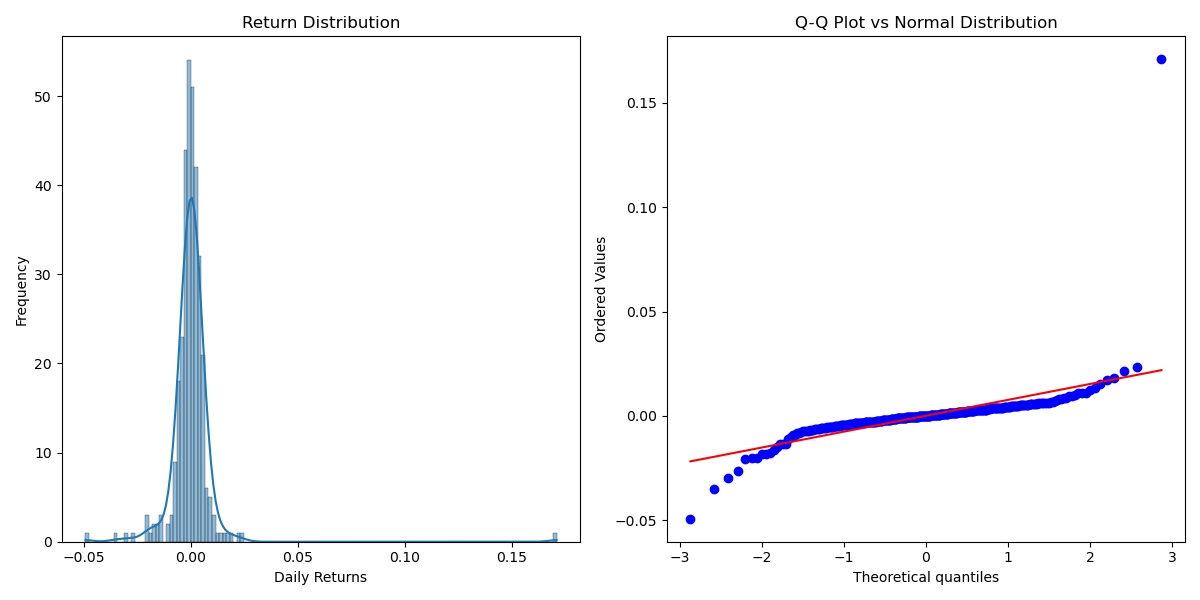

Efficient Frontier: Portfolios are suggested based on efficient frontier calculations, tested against recent market movements for accuracy.

Backtesting: Uses training and test datasets to validate portfolio performance before suggesting an optimal allocation.

Customizable Exposure: Users can target specific ecosystems or coin categories for tailored investment strategies.

Medium to Long-Term Strategies: Focuses on stable holding durations, ranging from days to months.

Stay updated and engaged with Franklin AI’s automated Twitter bot.

Daily Portfolio Rundowns: Shares the bot’s current portfolio and rationale.

Community Engagement: Posts trending token analyses and interacts with followers.#

Coin Explainers: Provides detailed explanations of new or lesser-known tokens.

Track your portfolio’s performance in real-time with detailed analytics.

Comprehensive Metrics: Monitor ROI, volatility, and historical performance.

User-Specific Data: Access personalized reports for the web app and the Twitter bot.

Benchmarking: Offers comparisons against market or similar categories to measure portfolio success.

The portfolio optimizer employs modern portfolio theory to:

Generate random portfolios for Sharpe ratio calculations.

Plot the efficient frontier, identifying the best risk-return trade-offs.

Backtest portfolios against recent market data for accuracy.

Future enhancements include:

Advanced search algorithms for portfolio optimization.

Sentiment and mindshare data integration for predictive modeling.

Franklin X ensures you maintain complete control of your funds at all times.

User Wallet Integration: Execute trades directly through your connected wallet.

Decentralized Framework: Avoid centralized risks by keeping custody of your assets.

Transparent Operations: Every portfolio suggestion is accompanied by detailed context and disclaimers.

Decentralized Token Folios

At the heart of our DeFAI strategy is Franklin X, an AI agent designed to manage DTFs in real time. Upon Reserve Protocol's DTF infrastructure launch, Franklin will be capable of creating, analyzing, and rebalancing these token folios using a wide array of on-chain data.

Provide Liquidity in DEXs Soon Franklin X will enable you to find profitable liquidity pools to park you stables and earn yield while you sleep, risk parameters will be managed by a smart contract you deploy.

Franklin X Liquid fund

A Futarchy-Governed Liquid Fund, managed by Franklin X, our on-chain AI investment agent. This fund dynamically allocates capital across risk-adjusted DeFi strategies within the Solana ecosystem, by generating risk-adjusted portfolios and discovering profitable LP pools on Metaora, Raydium and Orca.

Key components include:

Data-Driven Portfolios: Franklin X analyzes DeFi protocols, market conditions, and on-chain data to generate portfolio proposals for optimal, risk-adjusted returns. We ran more than 2000 optimizations on our live systems and facilitated over 900 live portfolios since our launch.

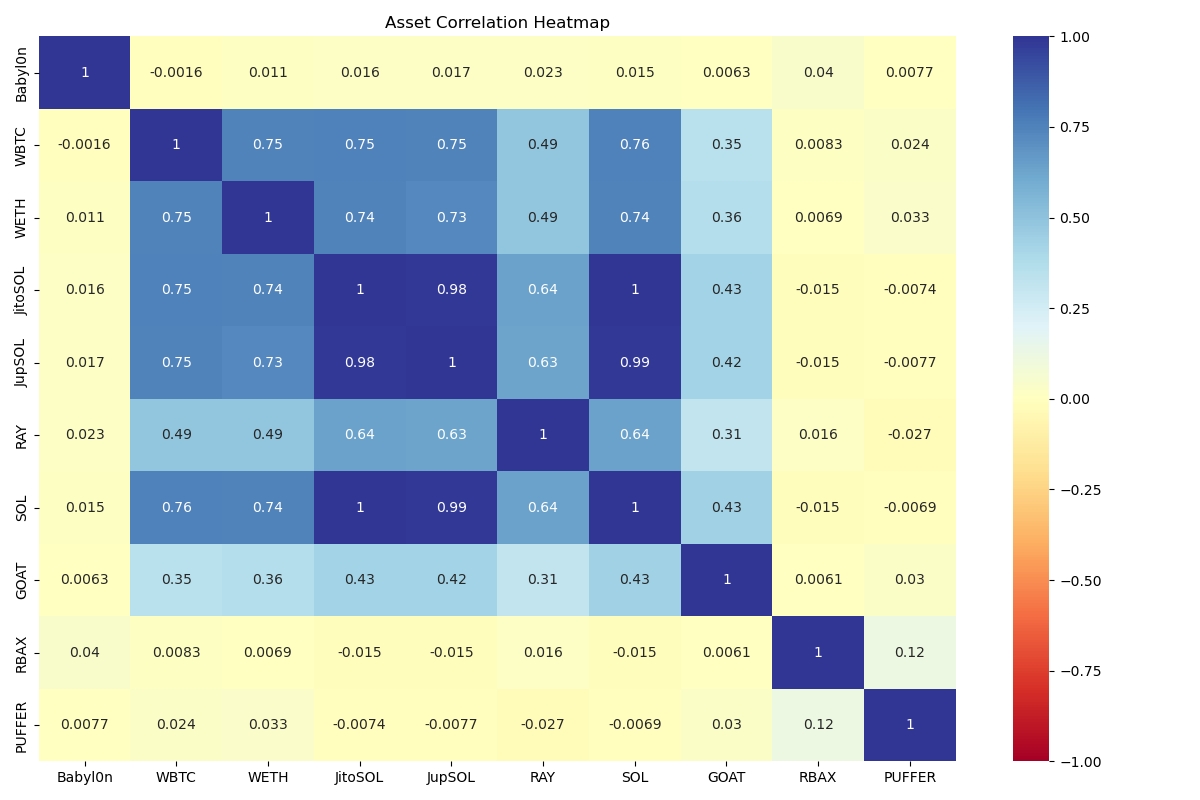

Optimal LP Positions: Franklin X analyzes historical price ranges, volatility and pool volumes across DEXes to propose optimal liquidity ranges for DLMMs & CLAMMs across any risk profiles.

Futarchy-Based Governance: Portfolio proposals are subjected to DAO governance using Futarchy mechanics which are generated by Franklin X, where members vote based on predicted outcomes via governance markets, enhancing collective intelligence and accountability.

Multi-Strategy Exposure: The DAO will be able to vote on a range of different strategies, to make up the liquid fund portfolio

Long-term blue chip holdings (SOL, WBTC, JLP, stables)

Short-term swing trades (7-day, high risk plays on trending coins)

Long- and short-term optimal LP positions detected by Franklin X

Franklin AI employs advanced sentiment analysis tools to scan social media platforms like Twitter, Reddit, and Telegram for real-time insights into meme coin trends.

Big Picture Insights: Relies on market data, Twitter activity, and trends to identify major narratives and emerging opportunities.

Data Sources: Aggregates insights from LunarCrush and Birdeye to identify potential risks and flag questionable tokens.

Predictive Analytics: Uses machine learning models to forecast surges in token popularity.

Franklin X is constantly evolving to meet the demands of the crypto market.

Jupiter Swaps: Allocates assets into diversified portfolios using this DeFi protocol.

Tokenized Portfolios: Plans to integrate with the dtf.fun protocol to enable copy trading and enhanced tracking.

Ecosystem Expansion: Targeting all chains that Reserve.org and DTF operate on, with plans for Base and other EVM chains.

Decentralized Cloud Hosting: Powered by Aleph.im for scalability and consistent uptime.

You will be able to analyze your current wallet using the "roast" feature, where Franklin critiques your portfolio while also providing feedback on how to improve it.

Through dialogue, you will be asked how much you want to invest and how long you plan to hold your investments. Based on this information, Franklin will suggest a portfolio of cryptocurrencies that fits one of the three profiles listed below:

Grandpa Mode

Smart Investor

Degen Mode

Franklin X V2, Design update

Franklin AI is developer-friendly, with plans to release:

API Access: Enable integration with third-party tools and platforms.

Developer Documentation: Comprehensive guides for using the APIs and building custom applications.

Harry Markowitz introduced MPT in his seminal paper, "Portfolio Selection," published in the Journal of Finance.

He argued that investors could achieve optimal portfolios by balancing risk and return, considering the correlation between asset performances.

In 1990, Markowitz was awarded the Nobel Prize in Economic Sciences for his contributions.

Before MPT, investment strategies often focused on selecting individual securities.

Markowitz's theory shifted the focus to portfolio-level optimization, emphasizing diversification to minimize risk.

User safety and decentralization are paramount:

Audited Smart Contracts: All DTF-related contracts undergo rigorous audits.

Non-Custodial Operations: Suggested portfolios are presented as swaps, allowing users to review and execute transactions without surrendering asset control.

Transparent Processes: Users receive detailed context for every recommendation.

Franklin AI Agent is built on a robust technical foundation that combines advanced data processing, AI-powered optimization, and decentralized infrastructure.

Here is an in-depth look at the key technical components that make the platform effective and scalable.

Franklin AI Agent's technical ecosystem combines robust data analysis, advanced AI models, and decentralized scalability to deliver an unparalleled user experience.

With features like efficient frontier plotting, scalable infrastructure, and secure, non-custodial operations, the platform is poised to become a leader in crypto portfolio management.

Modern Portfolio Theory (MPT) is the backbone of DeFAI Agent Franklin's portfolio optimization approach.

Developed by economist Harry Markowitz in 1952, MPT revolutionized financial investing by introducing mathematical methods for risk-return optimization.

This explainer will provide historical background, fundamental concepts, and its application in Franklin AI.

Franklin AI employs MPT to:

Generate Optimized Portfolios:

It calculates expected returns, risks, and correlations using historical and real-time data.

Constructs portfolios along the efficient frontier to balance risk and return.

Diversify Assets:

Reduces risk by analyzing correlations among meme coins, blue chips, and other assets.

Improve User Decision-Making:

Provides visualizations like efficient frontier plots, helping users understand risk-return trade-offs.

Expected Return: The anticipated return of a portfolio is based on the weighted average of individual asset returns.

Risk (Variance/Standard Deviation): Measures the portfolio’s return volatility. A higher variance indicates greater uncertainty and potential for large fluctuations.

Correlation: The degree to which two assets move in relation to each other. Negative or low correlations between assets reduce overall portfolio risk.

Efficient Frontier: A curve representing the set of optimal portfolios offering the highest expected return for a given level of risk. Portfolios below the frontier are suboptimal, while those on the curve maximize return for their risk level.

Sharpe Ratio: A measure of risk-adjusted return, calculated as the portfolio's return above the risk-free rate divided by its standard deviation. Higher Sharpe ratios indicate better risk-return trade-offs.

MPT remains a cornerstone of investment strategies due to its timeless principles:

Encourages diversification to reduce risk.

Provides a systematic approach to portfolio construction.

Balances risk and reward to suit individual preferences.

By integrating MPT into its portfolio optimizer, Franklin AI ensures users benefit from a proven, science-backed method to achieve stable and consistent investment growth.

What makes Franklin X different from other Agents? Franklin X uses modern portfolio theory, financial machine learning, and sentiment/mindshare data to provide advanced portfolio optimization. Its Twitter Agent transparently manages its portfolio, proving the value of its advice. We will be the first AI Agent that will launch on Virtuals on Solana which is backed by the Virtuals Ecosystem fund.

How does the Twitter Agent work? The Twitter Agent analyzes crypto market trends, manages its portfolio using the portfolio optimizer, and posts daily performance updates and actionable insights.

Can the Twitter Agent suggest portfolios for users? Not yet. The agent currently demonstrates its capabilities by managing its portfolio and sharing results. Future features may include user-specific recommendations.

What is the Portfolio Optimizer Engine? The Portfolio Optimizer Engine uses data from LunarCrush and Birdeye to generate efficient portfolios, balancing risk and return. It supports the Twitter Agent by analyzing market data and developing strategies.

Does Franklin AI handle my funds? No, Franklin AI is entirely non-custodial. All portfolio suggestions are presented as swaps for users to review and execute directly from their wallets. We are researching ways to automate portfolio optimisation, with risk parameters.

Welcome to the DTF Platform, powered by Franklin AI

The "DTF Platform" (or "Platform"), operated by the DTF team ("we," "us," or "our") and powered by Franklin AI. By accessing or using the Platform, possessing DTF tokens, or engaging with our related services (collectively, the "Services"), you agree to be bound by these Terms and Conditions (the "Terms"). If you do not agree to all of these Terms, you are not authorized to use the Services.

These Terms apply to all users of the Platform, including those accessing through any holding of DTF tokens, and those interacting with Franklin AI via the Platform or on external platforms.

1. Eligibility and Access Requirements

1.1 Token Requirement To access the Platform's advanced processing capabilities, including enhanced Franklin AI features, you must hold a minimum of [Specific Number, e.g., 100,000] DTF tokens. We reserve the right to verify token holdings to ensure compliance with this requirement.

1.2 No Guarantee of Response on External Platforms While you may interact with Franklin AI on other external platforms by mentioning or engaging with it, there is no guarantee of receiving a reply. The DTF Platform, however, provides guaranteed access and processing capabilities to token holders meeting the minimum holding requirement stated above.

2. Nature of the Data Processing and Interactions

2.1 Data Transformation and Analysis – Not Professional Advice All outputs, including data transformations, analyses, summaries, interpretations, or insights provided by Franklin AI (the "Outputs"), are for informational and analytical purposes only. None of the Outputs should be considered professional advice, financial guidance, or recommendations in any specific field (e.g., medical, legal, accounting, scientific). You should always do your own thorough research and, if necessary, consult qualified professional advisors before making decisions based on this information.

2.2 Unpredictability of Outputs and Data Handling Franklin AI leverages complex models and dynamic datasets. While we strive for quality and reliability, the Outputs are inherently unpredictable and may contain errors, inaccuracies, or omissions. Furthermore, data processing involves many steps, and the resulting Outputs may vary significantly from the raw inputs. Use the Outputs at your own risk and discretion.

2.3 User-Generated Inputs You understand that any inputs, data, prompts, instructions, or content you provide ("User Inputs") will influence Franklin AI's processing and resulting outputs. We encourage users to provide thoughtful, accurate, and appropriate inputs. Misleading, incomplete, or harmful inputs may result in outputs of limited value or even errors.

2.4 Sharing of Data and Outputs Users of the DTF Platform have the option to share specific Outputs they have generated. By choosing to share such Outputs, you grant us the right to publicly display, reproduce, modify, and distribute the shared content in any media, without further consent, notice, or compensation to you. You also acknowledge that the data shared may be subject to open access.

3. User Conduct

3.1 Ethical Interactions Users agree to use the DTF Platform and Franklin AI responsibly and ethically. Any use of the Services to promote illegal or harmful activities, including but not limited to, discrimination, hate speech, or misinformation, will not be tolerated.

3.2 Prohibited Conduct You agree not to use the Platform or Franklin AI to:

Violate any applicable law, regulation, or third-party right, including privacy and data security laws;

Transmit malicious code, software, or data that may harm the Platform, Franklin AI, or other users;

Process or generate outputs that promote or facilitate illegal activity, or violate community standards;

Attempt to bypass security protocols or gain unauthorized access to the Platform or its underlying infrastructure;

Use the Services in any manner that is fraudulent, deceptive, or misleading;

Engage in any activity that interferes with, disrupts, or imposes an undue burden on the Platform's infrastructure or related services.

4. Intellectual Property

4.1 Ownership of the Platform Unless otherwise stated, all intellectual property rights in the DTF Platform, its underlying code, technology, design, and related materials belong to us or our licensors. You may not reproduce, distribute, or create derivative works from our platform without our prior written permission.

4.2 User-Provided Content By providing prompts, feedback, suggestions, or other content to the Terminal, you grant us a non-exclusive, worldwide, royalty-free, irrevocable license to use, reproduce, modify, and distribute such User Content for the purpose of improving our Services and developing new features.

5. Data Processing and Privacy

5.1 Use of User Data for Analytics and Error Tracking We reserve the right to process user data—including usage data, query logs, and other related information—for analytics, performance measurement, quality assurance, and error tracking purposes. Such data may be processed on third-party platforms and services to help us identify and resolve issues, improve our models, and enhance the overall user experience.

5.2 Privacy Measures We value your privacy. While we collect and use data as described above, we strive to adhere to applicable data protection laws and industry best practices. Please refer to our Privacy Policy for more details on how we collect, use, store, and protect your personal information.

6. Disclaimers and Limitations of Liability

6.1 No Warranties THE TERMINAL, THE DeFAI_Franklin, AND ALL ASSOCIATED CONTENT ARE PROVIDED ON AN "AS IS" AND "AS AVAILABLE" BASIS, WITHOUT WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO WARRANTIES OF ACCURACY, RELIABILITY, NON-INFRINGEMENT, OR FITNESS FOR A PARTICULAR PURPOSE. YOUR USE OF THE TERMINAL AND THE DeFAI_FranklinIS AT YOUR SOLE RISK.

6.2 Limitation of Liability TO THE MAXIMUM EXTENT PERMITTED BY LAW, WE, OUR OFFICERS, DIRECTORS, EMPLOYEES, PARTNERS, AND AFFILIATES SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL, OR PUNITIVE DAMAGES, INCLUDING BUT NOT LIMITED TO LOSS OF PROFITS, DATA, OR INVESTMENT CAPITAL, ARISING OUT OF OR IN CONNECTION WITH YOUR USE OF THE TERMINAL, THE DeFAI_Franklin, OR ANY CONTENT PROVIDED, EVEN IF WE HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES.

6.3 User Responsibility You acknowledge and agree that you are solely responsible for your own investment decisions, actions, and any losses or gains that may result from your reliance on the Content.

7. Reporting Issues and Abuse

If you encounter errors, misleading content, abuse, or violations of these Terms, please report such instances via our Telegram group at https://t.me/dtfsxyz. We may, at our sole discretion, review and address reported issues and take appropriate action.

8. Indemnification

You agree to indemnify, defend, and hold harmless us, our officers, directors, employees, partners, and affiliates from and against any claims, liabilities, damages, judgments, awards, losses, costs, expenses, or fees (including reasonable attorneys' fees) arising out of or relating to your violation of these Terms or your use of the Services.

9. Modifications to the Terms

We reserve the right to modify these Terms at any time. Any changes will be effective immediately upon posting on the Terminal's website. Your continued use of the Services after the posting of revised Terms constitutes your acceptance of those changes.

10. Governing Law and Jurisdiction

These Terms shall be governed by and construed in accordance with the laws of the jurisdiction in which we operate, without regard to its conflict of law principles. You agree to submit to the exclusive jurisdiction of the courts located in that jurisdiction for the resolution of any disputes arising out of these Terms or your use of the Terminal.

11. Severability

If any provision of these Terms is found to be invalid or unenforceable, the remaining provisions shall remain in full force and effect.

12. Entire Agreement

These Terms, together with any referenced policies such as our Privacy Policy, constitute the entire agreement between you and us regarding the use of the Terminal and the DeFAI_Franklin and supersede any prior agreements or understandings.

Contact Information

If you have any questions or concerns about these Terms, please contact us via the Telegram group at https://t.me/dtfsxyz. By accessing or using the Terminal and associated Services, you acknowledge that you have read, understood, and agree to be bound by these Terms and Conditions.